Tesla stops Model 3: chips are missing and it's a problem

Tesla stops Model 3

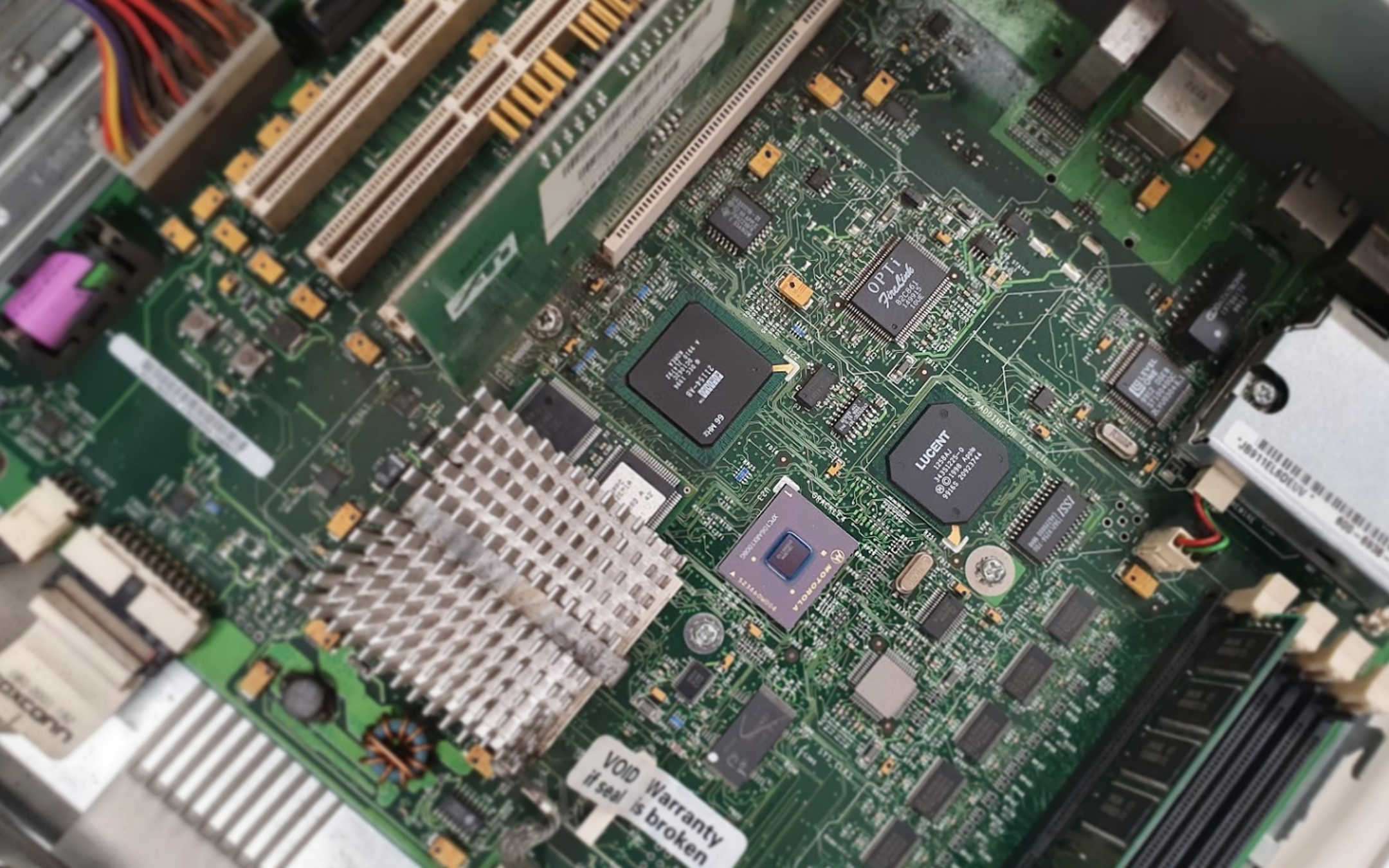

The future international geopolitical balances, it now seems increasingly clear, pass through the world of semiconductors. The signs of this have been felt for months now, after the belief that the bottleneck would soon manifest itself for years has spread. The feeling is that the knots are about to come to a head and that on this front some dangerous fuses will light up, destined to explode in the years (months?) To come.Chip problem: three clues

Three clues prove it and the three clues arrived within a few days. The first is in the increased conviction with which Europe has begun to manifest the need for research and development in this area, seeking the collaboration of the private world and promising IPCEI useful for subsidizing initiatives that can improve the production chain of chips. The second is in the fact-finding investigation launched by the White House to understand if and where to intervene to prevent a chip shortage from restricting the US market potential.The third clue is perhaps the most dangerous, a little 'because it sounds like confirmation, partly because it exacerbates the seriousness of the phenomenon: the Tesla group would have temporarily suspended part of the production on the Model 3 precisely because of the lack of chips. In short, in the absence of essential elements, nothing else can be done but slow down production (even if on the eve of what was hoped to be a moment of rebound for the automotive market) and wait for the problem to soften its edges. br>

As early as the beginning of 2020, Tesla had actually manifested the first problems: it had mounted old chips on some cars in distribution, promising to replace them as soon as the new supplies reached the company. That action, which sounded like an out of tune forcing, was probably the first sign of something that was about to happen and which, partly accelerated and partly hidden by the pandemic, has now surfaced more clearly.

Volkswagen had already warned the market at the end of 2020: the lack of chips is not just a temporary circumstance, but a serious problem that makes the supply of semiconductors and rare earths a geopolitical issue above all. Like all geopolitical issues, it will have unexpected branches and potentially harmful consequences for some parts of the market, but at the same time also a development that is difficult to predict. Only one thing seems clear: it is a serious problem, with serious repercussions and serious importance.

Tesla Halted Model 3 Production in Fremont for Two Days Because of Parts Shortages

Benzinga

Warren Buffett In Annual Letter Signals More Stock Buybacks Coming This Year, Says Don't 'Bet Against America'Warren Buffett in his annual letter to shareholders offered words of encouragement to a battered country while also signaling that more stock buybacks are to come. Buffett's Annual Letter: The letter from the 90-year-old chief executive officer of Berkshire Hathaway Inc. (NYSE: BRK-A) (NYSE: BRK-B) was even more anticipated than usual this year, because his influential voice has largely been silent since his last letter, which came in the very early days of the pandemic. A lot has happened since, from the contentious election and ensuing fallout, to the arrival of retailer investors pushing 'stonks,' not to mention the meteoric rise of Bitcoin (CRYPTO: BTC). Buffett's lieutenant, Berkshire Hathaway Vice Chairman Charlie Munger, spoke on Wednesday about some of these issues. He said the trading in stocks such as GameStop Corp. (NYSE: GME) was tantamount to 'betting on racehorses' and cast doubt on the idea that Bitcoin will ever replace regular money as the world's primary medium of exchange. Buffett in his letter did not talk about cryptocurrency or GameStop, but he did touch on the turmoil of the past year, without directly referencing any particular event. He used the stories of companies throughout the country that he has invested in, such as GEICO and Pilot Travel Centers, to deliver a simple, clear message: 'Never bet against America.' (Italics in original.) 'There has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking,' he wrote. 'Beyond that, we retain our constitutional aspiration of becoming 'a more perfect union.' Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so.' Earnings, Stock Repurchases: As for the latest numbers on the company's performance, the letter showed Berkshire earned $42.5 billion last year, down 48% from 2019's $81.4 billion. This included an $11 billion loss from a write-down in subsidiary and affiliate businesses, particularly the 2016 purchase of Portland, Oregon-based metal fabricator Precision Castparts. The company does business in the aerospace industry — not the best one to be in last year. In his letter, Buffett said he overpaid for the company and that last year's 'adverse developments' in the industry made that clear. 'I was simply too optimistic about PCC’s normalized profit potential,' Buffett wrote. The company spent $24.7 billion to repurchase the equivalent of 80,998 'A' shares last year, including $9 billion in the fourth quarter. That is likely to continue: 'Berkshire has repurchased more shares since year-end and is likely to further reduce its share count in the future,' Buffett wrote. Berkshire also as usual listed its top holdings by market value. They included Apple Inc (NASDAQ: AAPL), Coca-Cola Co (NYSE: KO), American Express Company (NYSE: AXP) and Bank of America Corp (NYSE: BAC). Filings from Berkshire earlier this month showed the company trimmed its positions in Apple while piling into drug, telecom and oil companies in the latest quarter. Recent Price Action: Berkshire's class B shares ended Friday at $240.51, down for the week at 0.54%. Class A shares were down 0.88% to $364,580. Photo Courtesy Wikimedia Commons. See more from BenzingaClick here for options trades from BenzingaBitcoin Hits Another All-Time High30,000 Macs Infected With Newly Detected Form Of Malware, Dubbed 'Silver Sparrow'© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.